Indicators on Pvm Accounting You Should Know

Indicators on Pvm Accounting You Should Know

Blog Article

All about Pvm Accounting

Table of ContentsExcitement About Pvm AccountingThe Definitive Guide to Pvm AccountingPvm Accounting for Beginners7 Easy Facts About Pvm Accounting ExplainedSome Ideas on Pvm Accounting You Need To KnowNot known Details About Pvm Accounting

Make sure that the accounting process abides with the law. Apply called for construction accountancy requirements and treatments to the recording and reporting of construction task.Communicate with different financing firms (i.e. Title Company, Escrow Company) relating to the pay application procedure and needs needed for payment. Help with carrying out and keeping internal financial controls and procedures.

The above statements are meant to explain the basic nature and degree of job being executed by individuals assigned to this classification. They are not to be interpreted as an extensive listing of duties, obligations, and abilities required. Workers may be required to carry out responsibilities outside of their normal responsibilities once in a while, as required.

The Ultimate Guide To Pvm Accounting

Accel is looking for a Building Accounting professional for the Chicago Office. The Construction Accountant does a variety of accountancy, insurance conformity, and project management.

Principal duties include, yet are not limited to, taking care of all accounting functions of the firm in a timely and accurate way and supplying reports and timetables to the company's CPA Firm in the prep work of all financial declarations. Ensures that all accountancy treatments and functions are taken care of precisely. In charge of all financial records, pay-roll, financial and daily procedure of the audit function.

Prepares bi-weekly test equilibrium records. Functions with Task Supervisors to prepare and post all monthly invoices. Processes and issues all accounts payable and subcontractor payments. Generates monthly recaps for Workers Compensation and General Liability insurance premiums. Generates monthly Job Cost to Date records and collaborating with PMs to integrate with Task Supervisors' allocate each job.

Pvm Accounting for Beginners

Effectiveness in Sage 300 Building and Real Estate (formerly Sage Timberline Workplace) and Procore building administration software an and also. https://www.intensedebate.com/profiles/leonelcenteno. Must also excel in other computer software program systems for the preparation of reports, spread sheets and various other accounting evaluation that may be called for by administration. financial reports. Need to possess solid business skills and capacity to prioritize

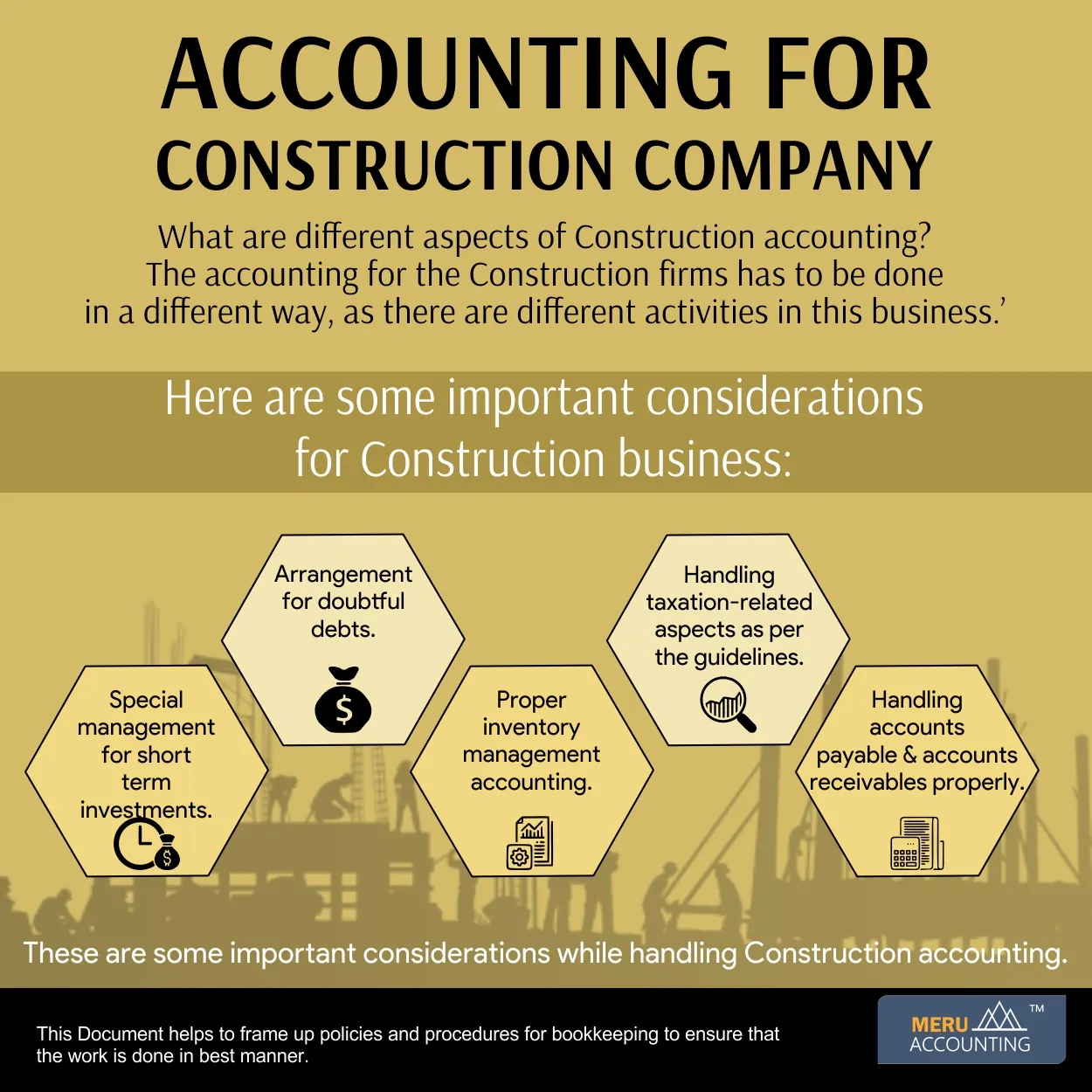

They are the economic custodians who make sure that building tasks stay on spending plan, follow tax obligation regulations, and preserve economic transparency. Building and construction accountants are not just number crunchers; they are critical partners in the building and construction process. Their main duty is to manage the monetary facets of construction projects, making sure that sources are assigned effectively and economic risks are lessened.

Some Known Questions About Pvm Accounting.

By keeping a limited grasp on task financial resources, accountants help prevent overspending and economic setbacks. Budgeting is a keystone of effective building projects, and building and construction accountants are important in this respect.

Browsing the complex internet of tax policies in the construction sector can be challenging. Construction accounting professionals are skilled in these policies and ensure that the task follows all tax obligation demands. This consists of handling pay-roll tax obligations, sales taxes, and any type of other tax obligation obligations details to building. To excel in the function of a construction accounting professional, individuals require a solid instructional structure in accounting and financing.

Furthermore, accreditations such as Licensed Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Sector Financial Specialist (CCIFP) are very concerned in the industry. Construction projects frequently involve tight deadlines, changing regulations, and unexpected expenses.

How Pvm Accounting can Save You Time, Stress, and Money.

Ans: Construction accountants develop and keep an eye on budget plans, determining cost-saving opportunities and making sure that the job stays within spending plan. Ans: Yes, learn the facts here now construction accounting professionals handle tax compliance for building and construction jobs.

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies need to make challenging choices amongst numerous economic options, like bidding on one task over one more, selecting funding for materials or devices, or setting a task's profit margin. Building is an infamously unstable industry with a high failing rate, sluggish time to payment, and irregular money circulation.

Manufacturing includes repeated procedures with easily recognizable expenses. Manufacturing needs various processes, materials, and devices with varying prices. Each task takes area in a new location with varying site problems and unique obstacles.

Some Known Details About Pvm Accounting

Resilient partnerships with vendors alleviate arrangements and improve effectiveness. Irregular. Constant use various specialized contractors and providers influences efficiency and capital. No retainage. Settlement gets here in full or with routine settlements for the complete agreement quantity. Retainage. Some section of payment may be withheld up until job conclusion also when the service provider's job is finished.

While traditional suppliers have the benefit of controlled settings and enhanced manufacturing procedures, construction firms need to continuously adjust to each new task. Even rather repeatable jobs require adjustments due to site problems and other variables.

Report this page